Attention creates noise. Lock-ins create leverage.

Arnav Bhardwaj

Growth Operator

Jan 27, 2026

In early 2025, two things happened that looked identical on the surface.

Solana released a promotional video for its Accelerate event that sparked immediate backlash. Crypto Twitter erupted with criticism. The video was pulled, leadership apologized, feeds amplified the controversy for days. Then everyone went back to building. Developers didn't leave. Validators didn't unstake. Applications didn't migrate. The outrage burned hot but changed nothing structurally.

Around the same time, Cluely rode provocative content to massive visibility spikes. View counts exploded, engagement surged, and every surface metric suggested inevitable momentum. Within weeks, retention flatlined. The audiences that arrived via provocation left just as fast. What appeared as growth revealed itself as pure algorithmic signal extraction with no residue.

Same year. Same distribution environment. Opposite outcomes. The pattern repeated across categories, and what separated survival from collapse wasn't narrative strength, technical superiority, or timing. It was Lock-In Velocity, the rate at which products convert attention into interactions that impose a real cost to unwind.

Most teams are still optimizing for metrics that predict nothing. They're sprinting toward a mirage tracking impressions, clicks, engagement, while missing the only velocity that determines whether attention converts to retention or evaporates when the algorithm moves on.

I've written about why attention stopped compounding and why rage bait became the dominant acquisition tactic in 2025. This piece focuses on the operational framework that determines which products compound advantage and which ones fragment when algorithmic attention shifts.

Attention Is a Rental. Lock-Ins Are Property.

When Solana's controversy hit, the ecosystem absorbed it because builders had already crossed irreversible thresholds. Modules shipped, capital staked, infrastructure dependencies formed structural commitments that outrage couldn't dislodge. The noise lived at the distribution surface while the real structure lay underneath.

Cluely's viral moments generated trivially reversible reactions: comments deleted, shares forgotten, hot takes evaporated. These interactions left no residue, changed no behavior, constrained no future choices. When the algorithmic wind shifted, nothing underneath held people in place.

Hyperliquid demonstrated this principle through mechanisms that made leaving measurably costly. The platform spent $644 million in 2025, 46% of all crypto buybacks that year repurchasing HYPE tokens, with 97% of trading fees directed to buybacks that reduced circulating supply by over 21 million tokens. Users staking HYPE earned yields up to 55% annually. Developers building on Hyperliquid's custom L1 couldn't easily port infrastructure elsewhere without rewriting for different consensus mechanisms. Capital deployed in HLP vaults, earning double-digit APY, created economic alignment that pure trading never generates.

When competitive pressure emerged, Aster briefly commanded significant market share with $700 million in daily volume at its peak. Hyperliquid maintained structural position despite the noise. Why? Because users faced mounting costs to leave: staked capital earning yield, deployed infrastructure specific to the L1, accumulated trading history that fed better execution, and token holdings appreciating through buybacks. Aster could match trading features but couldn't replicate the structural advantage that took months to accumulate.

This distinction reveals the measurement problem most teams face: tracking impressions while missing the only metric that predicts retention, how many people moved into states they can't easily exit.

When Lock-In Velocity Isn't Enough

Before we treat Lock-In Velocity as a silver bullet, consider FTX.

FTX had extreme lock-in velocity. Users had capital deposited across trading accounts, API integrations wired into algorithmic strategies, whitelisted withdrawal addresses that took 24 hours to modify, and custom permission logins that governed team access. When the exchange froze withdrawals in November 2022, over one million users couldn't access their funds. An $8 billion hole in the balance sheet exposed itself only when withdrawal pressure spiked. Users eventually recovered 10-25% of their capital after years of bankruptcy proceedings.

FTX's lock-in mechanisms were sophisticated: multi-factor authentication, withdrawal delays, address whitelisting, and staking programs. The switching costs were real. Users lost access to trading history, saved strategies, and integrated workflows when they left. Yet the platform collapsed catastrophically despite these high exit barriers.

The lesson: Lock-In Velocity, built on fraudulent foundations, accelerates collapse rather than preventing it. When the underlying value proposition is fiction, lock-ins become toxic traps rather than structural advantages. The velocity that should compound trust instead amplifies betrayal.

This is why Lock-In Velocity requires legitimate foundations. It's not about making exit difficult, it's about making exit costly because users would lose genuine accumulated value. The distinction matters because it separates sustainable growth from predatory design.

How Lock-In Velocity Actually Works

The framework operates through three mechanisms that convert visibility into compounding structural advantage when built on legitimate foundations:

Design for Meaningful Commitment

The foundation replaces vague "engagement" with interactions that create persistent state change. The constraint is intentionality these must feel like value unlocked, not friction added.

A one-click integration that syncs calendar data or wires into a CRM starts generating utility immediately. Users experience this as a capability gained, but once data flows through your product into daily workflow, removal becomes costly. They lose automation, history, and the compounding value of time invested in setup.

Base understood this when they moved beyond "developer-first blockchain" messaging into consumer wallets and social integrations. Each on-chain transaction, saved wallet configuration, or connected social identity created small but persistent lock-ins. Switching cost wasn't technical it was practical. Your history, connections, and accumulated context lived there.

Economic alignment through stakes works similarly. When Polymarket users place predictions, they're committing capital to specific outcomes. That stake creates psychological investment that passive scrolling never generates. Win or lose, the interaction produced sa tate change that casual browsing couldn't.

Progressive status and coordination-gated features compound these effects. Farcaster's Frames created lock-in through social graph integration and collaborative casts. Early movers accumulated followers, created channels, and built a reputation. Leaving meant abandoning accumulated social capital.

Measure Three Primitives

Lock-In Velocity becomes operational through measurable signals:

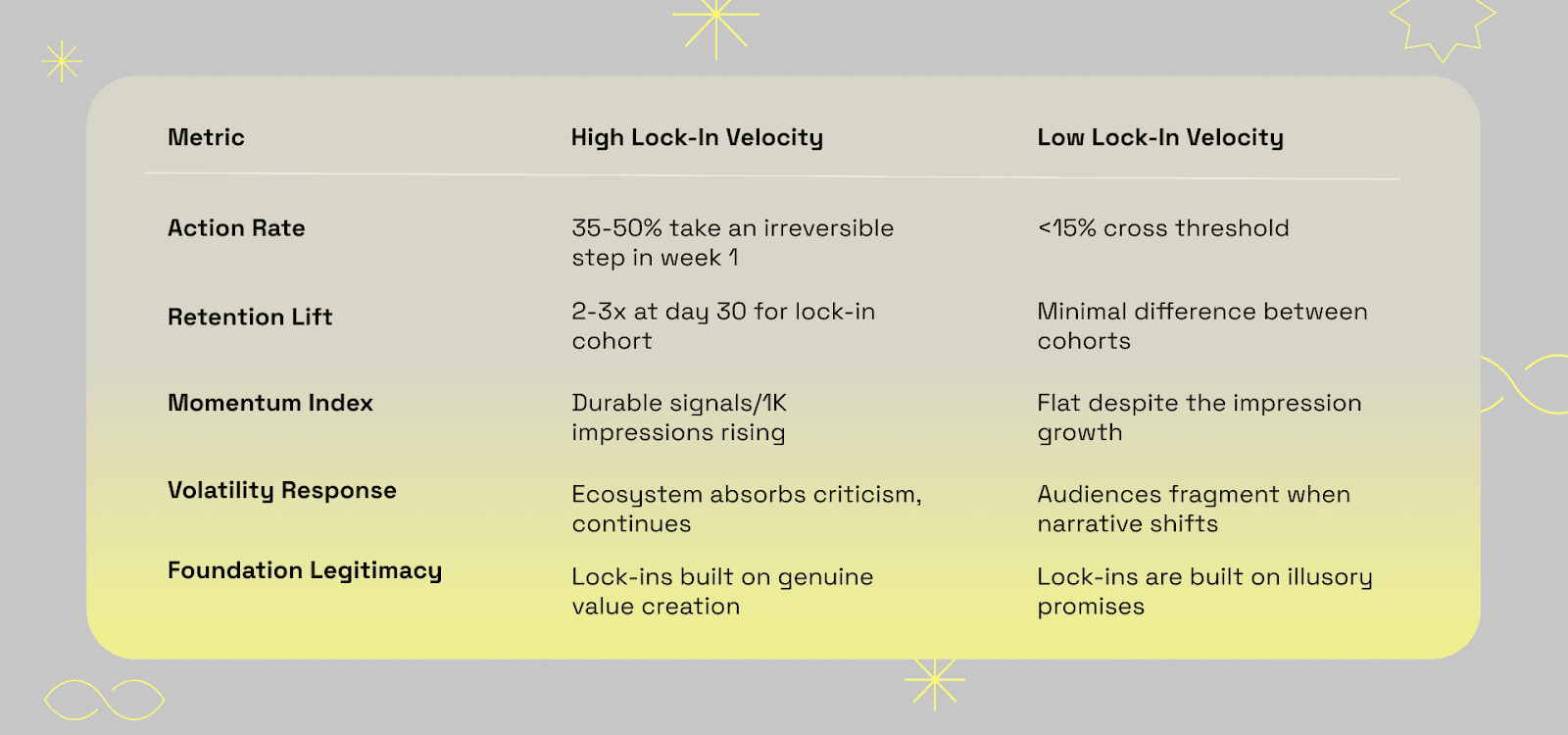

Action Rate tracks the proportion of new users who take irreversible actions within seven to fourteen days. For Solana, deploying a contract or staking SOL. For a SaaS tool, completing an integration that syncs real data. For a consumer app, connecting a wallet or creating something shareable. If fewer than 30-40% of activated users cross this threshold in week one, attention leaks faster than you convert it into a structural advantage.

Retention Lift measures the delta between cohorts who crossed irreversible thresholds and those who didn't. This isolates the causal impact of lock-in interactions on retention curves. In most products, users who took even one lock-in action show 2-3x retention at day 30 versus those who only browsed.

Momentum Index composites durable signals into a single ratio: active integrations, paid conversions, returning contributors, or staked capital per thousand impressions. When the Momentum Index rises, growth becomes structurally more efficient. When it stalls, you're generating motion without accumulation.

Compound Through Traces

The system becomes self-reinforcing when you capture every lock-in as a structural trace the product can reference. Each interaction creates persistent signals: integration state, wallet history, shared artifacts, and coordination records.

These traces raise switching costs because users lose accumulated value if they leave. A developer who deployed three contracts on Solana doesn't just lose code they lose transaction history, network context, and debugging patterns that make future development faster.

They create machine-readable social proof. AI agents and recommendation engines index these traces as evidence of utility. When an LLM evaluates "which blockchain should I build on," it samples deployment activity, active integrations, and network effects traces of lock-in velocity, not marketing claims.

They feed product primitives that reduce friction for subsequent actions. Onboarding leverages existing traces. Cross-sell requires less setup. Features unlock based on prior commitment. Each action makes the next easier and more valuable.

Hyperliquid's sustained position despite fierce competition came from this compounding effect. Users with capital staked through the 55% APY program, infrastructure deployed on the custom L1, and history accumulated faced mounting costs to leave. Competitors could match trading features but couldn't replicate the structural advantage that took months to build and was continuously reinforced through $644 million in annual buybacks.

Why 2026 Makes This Inevitable

AI agents increasingly mediate how users find and evaluate products. These systems prefer trace-rich signals over marketing claims. Products that accumulate lock-in traces become easier for machines to select as reliable answers, creating a distribution advantage that compounds independently of marketing spend.

Attention saturation makes initial visibility cheaper but less meaningful. When anyone can generate reach through provocation or paid amplification, differentiation moves to what happens after attention arrives. Products converting visibility into lock-ins at higher velocity win compounding advantages over those relying on continuous re-acquisition.

Platform algorithms increasingly discount purely reactive engagement. Systems that once rewarded outrage now adjust toward depth signals time in utility mode, return frequency, and integration with real workflows. This shift favors products designed around lock-in mechanics rather than engagement hooks.

The Cluely pattern became common across consumer products in 2025: attention arrived fast through provocative content, then retention collapsed because nothing in the product created meaningful commitment. The funnel stayed wide and leaky.

The Solana, Hyperliquid, Polymarket, and Farcaster patterns showed up in products that survived volatility. Users had capital deployed, infrastructure integrated, or social graphs built commitments that outrage couldn't dislodge and that algorithmic shifts couldn't evaporate.

The Diagnostic

Start with your last three winning campaigns, features, or content pieces that moved numbers. For each, map what happened downstream: how many people who engaged took actions that couldn't be casually reversed within seven days?

If the answer approaches zero, you have visibility masquerading as growth, generating motion that resets with each algorithmic cycle.

Next, inventory your product's lock-in interactions. Identify mechanisms that persist state across sessions, get shared outside the product, or require coordination with others. If this inventory comes up empty or filled with superficial signals like likes or follows, you're optimizing for the wrong velocity.

Calculate your current Action Rate and Momentum Index. If fewer than your category benchmark crosses durable thresholds in week one, attention leaks. If the Momentum Index stays flat or declines despite rising impressions, efficiency at converting visibility into structure is degrading.

Check foundation legitimacy. Are your lock-ins creating genuine accumulated value, or are they friction masquerading as commitment? The FTX collapse proved that high lock-in velocity built on fraudulent foundations accelerates damage rather than creating resilience.

The Prediction

By Q4 2026, at least two projects currently in the top 20 by TVL will have collapsed despite maintaining high capital lock-in metrics throughout their decline. Why? Because they confused capital trapped by exit restrictions with capital retained by accumulated value. The market will distinguish between lock-ins built on genuine utility and lock-ins built on illusion.

The teams that survive won't be those with the highest barriers to exit. There will be those whose users face a genuine loss of history, capability, coordination, or compounding value when they leave.

Every growth metric you currently track measures the past. Lock-In Velocity predicts the future. The teams that instrument Action Rate, Retention Lift, and Momentum Index in Q1 will outcompete those who add these metrics in Q4 after watching competitors pull ahead.

The game hasn't gotten harder. Teams building for attention velocity are competing against teams building for lock-in velocity. Attention is a rental you pay every impression. Lock-ins are property that compounds every interaction. And by the end of 2026, the market will have made that distinction brutally clear.

Arnav Bhardwaj (@Arnav_ct) writes The Growth Stack, a weekly analysis of why smart teams make dumb growth decisions. He studies second-order effects across startups, media, and tech to find where incentives, narratives, and execution break.